What items are tax-free in Japan customs?。 ここで視聴してください – What is tax free customs in Japan

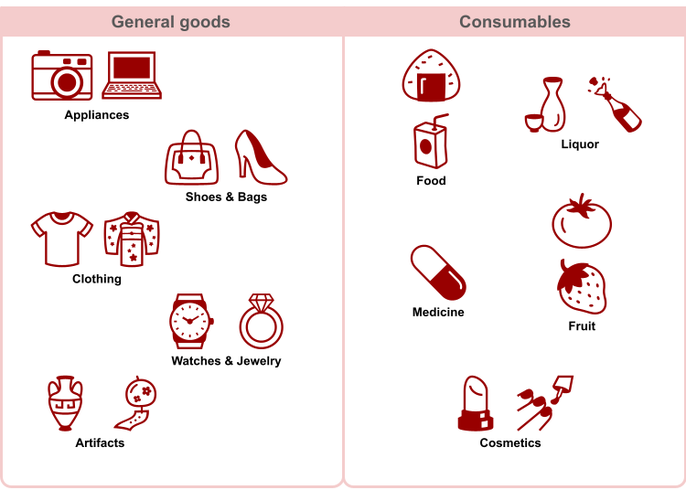

Any item whose overseas market value is under 10,000yen is free of duty and/or tax and is not included in the calculation of the total overseas market value of all articles.There is no duty-free allowance for articles having a market value of more than 200,000yen each or each set.・Prior to departure, please show the customs officer the tax free item(s) purchased as well as the "Record of Purchase of Consumption Tax-Exempt for Export Slip" attached to your passport. When you want to pack the tax free item(s) in your baggage, please ask to the airport staff before check-in.To fully enjoy shopping in Japan, you need to know about Japan's tax exemption program. Tax exemption in Japan basically applies to all items, from general items such as home appliances, accessories, and shoes, to consumable items such as alcohol, food, cosmetics, cigarettes, and medicines.

Don't forget to bring necessary items for tax-free procedure such as the purchased items and the receipt. The person who made the purchase must be identified when going through tax-free procedure There are different tax-free store signs for standard tax-free stores and one-stop tax-free procedure stores.

What happens if you open tax-free bag in Japan

If the items is not taken out of the country, consumption tax fees will be levied. The consumable goods which have been packed in the designated bags. Please do not open the designated bag until you leave Japan.

What goods are restricted by customs in Japan

Japan strictly prohibits entry of narcotics and related utensils, firearms, firearm parts and ammunition, explosives and gunpowder, precursor materials for chemical weapons, germs that are likely to be used for bioterrorism, counterfeit goods or imitation coins or currency, obscene materials, or goods that violate …If the bag is opened or products used, you will be required to pay consumption tax upon departure. ・The total purchase amount at the same store in a single day is ¥5,000 ~ ¥500,000 excluding tax (¥5,500 ~ ¥550,000 inlcuding tax).

Generally, the purchaser of the tax-free items must carry them when leaving Japan. If you plan to put your duty-free items in your checked baggage, please inform the airline staff at the check-in counter before checking in your luggage. A customs officer will come to the check-in counter to check your duty-free items.

How much is tax-free in Japan for foreigners

Tax-free shopping is available to foreign tourists at licensed stores when making purchases of over 5000 yen at a given store or mall on one calendar day. A passport is required when shopping tax-free.(A) Present your passport at the time of purchase and pay the total with consumption tax already deducted. (B) Get a refund by visiting the designated tax exemption bulk deduction counter, and presenting your purchases, purchase receipt, and passport.If the bag is opened or products used, you will be required to pay consumption tax upon departure. ・The total purchase amount at the same store in a single day is ¥5,000 ~ ¥500,000 excluding tax (¥5,500 ~ ¥550,000 inlcuding tax).

Customs procedure is also necessary when leaving the country. Customers who are carrying foreign goods or cash equivalent to 1 million yen, etc. should fill out the required items in the prescribed forms and present these to Customs in order to complete the customs procedure.

Customs selects the duty-free items in the travelers' favor and then imposes duties on the rest. There is no duty-free allowance for articles worth more than ¥200,000 each, for example, a bag worth ¥250,000, the duty will be imposed on the entire sum of ¥250,000.

Also, anything you bring back that you did not have when you left the United States must be "declared." For example, you would declare alterations made in a foreign country to a suit you already owned, and any gifts you acquired outside the United States.

What can I not bring back from Japan

Drugs such as stimulants and cannabis, cocaine, psychotropic drugs, narcotics, opium, MDMA are regulated in Japan. It is illegal to possess or use them and taking them out of Japan is also not permitted.

If the bag is opened or products used, you will be required to pay consumption tax upon departure. ・The total purchase amount at the same store in a single day is ¥5,000 ~ ¥500,000 excluding tax (¥5,500 ~ ¥550,000 inlcuding tax).If the bag is opened or products used, you will be required to pay consumption tax upon departure. ・The total purchase amount at the same store in a single day is ¥5,000 ~ ¥500,000 excluding tax (¥5,500 ~ ¥550,000 inlcuding tax).